The recent regulatory changes surrounding Paraíba tourmaline mining in Brazil have sent ripples through the gemstone industry, sparking debates among miners, traders, and conservationists alike. These new policies, enacted under Brazil's broader mineral resource protection framework, aim to strike a delicate balance between economic interests and environmental preservation in one of the world's most geologically significant regions.

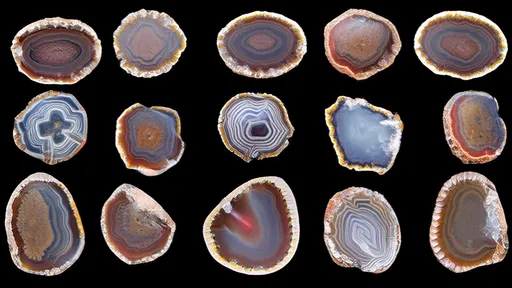

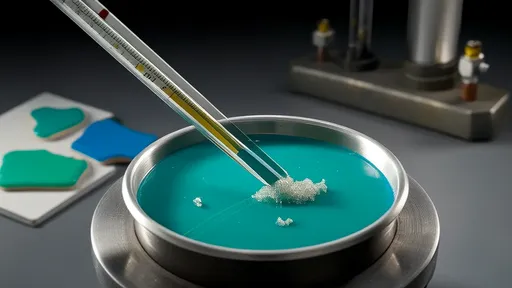

Brazil's Ministry of Mines and Energy unveiled the updated regulations last month, marking the first major overhaul of Paraíba mining rules in nearly a decade. The neon-blue tourmaline, discovered in the late 1980s in the state of Paraíba, has become one of the most sought-after colored gemstones in the global market. Its unique electric blue hue, caused by copper impurities, cannot be replicated by stones from other deposits, making the Brazilian source material particularly valuable.

At the heart of the new policy lies a fundamental shift in extraction philosophy. Where previous regulations focused primarily on production quotas and licensing procedures, the updated framework introduces comprehensive environmental impact assessments as a prerequisite for mining permits. "We're moving from a purely extractive model to one that considers the long-term sustainability of our mineral wealth," explained Ministry spokesperson Ana Beatriz Costa during the policy announcement.

The regulations establish strict zoning restrictions around known Paraíba tourmaline deposits, creating buffer areas where traditional mining methods are prohibited. These protected zones aim to prevent the kind of environmental degradation witnessed during the initial rush for Paraíba stones in the 1990s, when unregulated mining operations left scars across the landscape. Satellite monitoring will now be employed to detect illegal mining activities in real-time, with substantial fines for violations.

Perhaps the most controversial aspect of the new rules involves production caps. Each licensed operation will be limited to extracting no more than 500 grams of rough Paraíba tourmaline per month, a quantity that industry veterans claim barely justifies the operational costs. The government defends these limits as necessary to extend the life of known deposits, which geological surveys suggest may be exhausted within 15-20 years at current extraction rates.

Artisanal miners, who have traditionally played a significant role in Paraíba tourmaline discovery and extraction, face new challenges under the regulations. The policy requires all mining cooperatives to register with the National Mining Agency and submit detailed operational plans. While the government promises technical assistance and funding opportunities for compliance, many small-scale miners worry the bureaucratic hurdles will push them out of the industry.

The gemstone trade has responded with cautious optimism to the changes. "Limited supply will undoubtedly drive prices higher in the short term," noted São Paulo-based gem dealer Marco Aurélio Santos, "but we need to consider whether this will stimulate more smuggling or create a parallel black market." Indeed, the regulations include enhanced export documentation requirements, with each parcel of Paraíba tourmaline now needing a government-issued certificate of origin.

Environmental groups have largely praised the measures, though some argue they don't go far enough. The Brazilian Foundation for Sustainable Mining has called for complete moratoriums in ecologically sensitive areas, pointing to the irreversible damage caused by past mining activities. "These regulations are a step in the right direction," said foundation director Clara Montenegro, "but we're still trading short-term economic gain for long-term environmental costs."

Technological innovation emerges as an unexpected beneficiary of the new policy framework. The restrictions have prompted increased investment in advanced exploration techniques that minimize ground disturbance. Several mining companies are now experimenting with ground-penetrating radar and 3D mapping technologies to identify deposits with surgical precision, reducing the need for destructive test pits and exploratory trenches.

The academic community has also welcomed provisions that mandate knowledge transfer between mining operations and research institutions. "For the first time, we're seeing requirements for systematic geological documentation," observed University of Brasília geologist Eduardo Fonseca. "This data will be invaluable for understanding the formation of these unique copper-bearing pegmatites."

Implementation challenges loom large, however. The Brazilian mining sector has historically struggled with enforcement capacity, particularly in remote regions where Paraíba deposits are found. The success of these regulations may hinge on the government's ability to deploy sufficient inspectors and monitoring equipment. Early reports suggest special enforcement units are being trained, but their effectiveness remains to be seen.

International markets are watching these developments closely. The United States and China, as the largest consumers of high-end Paraíba tourmaline, could see significant price fluctuations as the new rules take effect. Some industry analysts predict a shift toward African copper-bearing tourmalines as alternatives, though purists maintain that nothing compares to the original Brazilian material.

Looking ahead, the Brazilian government has signaled that these regulations may serve as a template for other strategic minerals. The country's vast gemstone resources, including emeralds, aquamarines, and imperial topaz, could soon fall under similar protection frameworks. This holistic approach to mineral resource management reflects growing global concerns about responsible sourcing and sustainable extraction practices.

As the dust settles on these policy changes, one thing becomes clear: the era of unrestricted Paraíba tourmaline mining in Brazil has ended. Whether these measures will successfully preserve both the environment and the economic viability of this rare gemstone remains an open question that only time—and strict enforcement—can answer.

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025

By /Jul 30, 2025